single life annuity vs lump sum

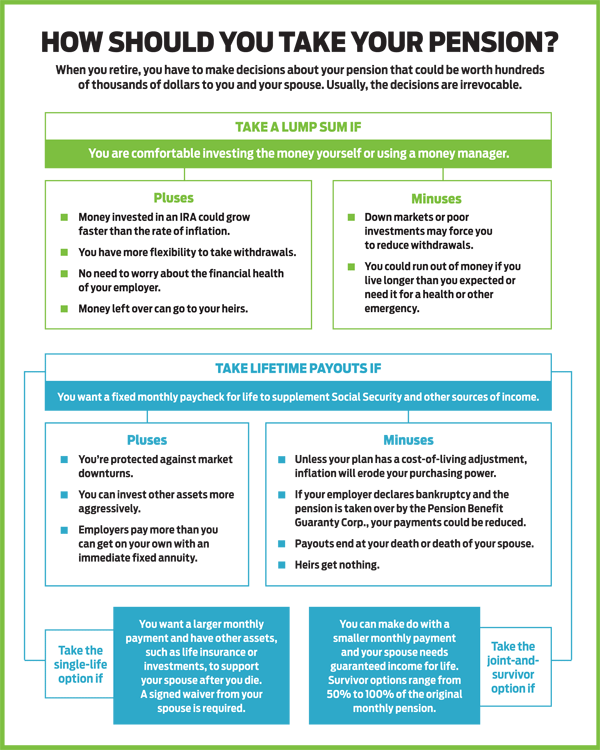

A lump sum annuity payout may seem to be a good option especially if you wish to exercise complete control over your financial portfolio. Truth is annuities are often the better deal says Bob Kargenian an Orange California-based financial adviser noting that companies offering these buyouts are doing so.

Does An Annuity Plan Work For You Businesstoday

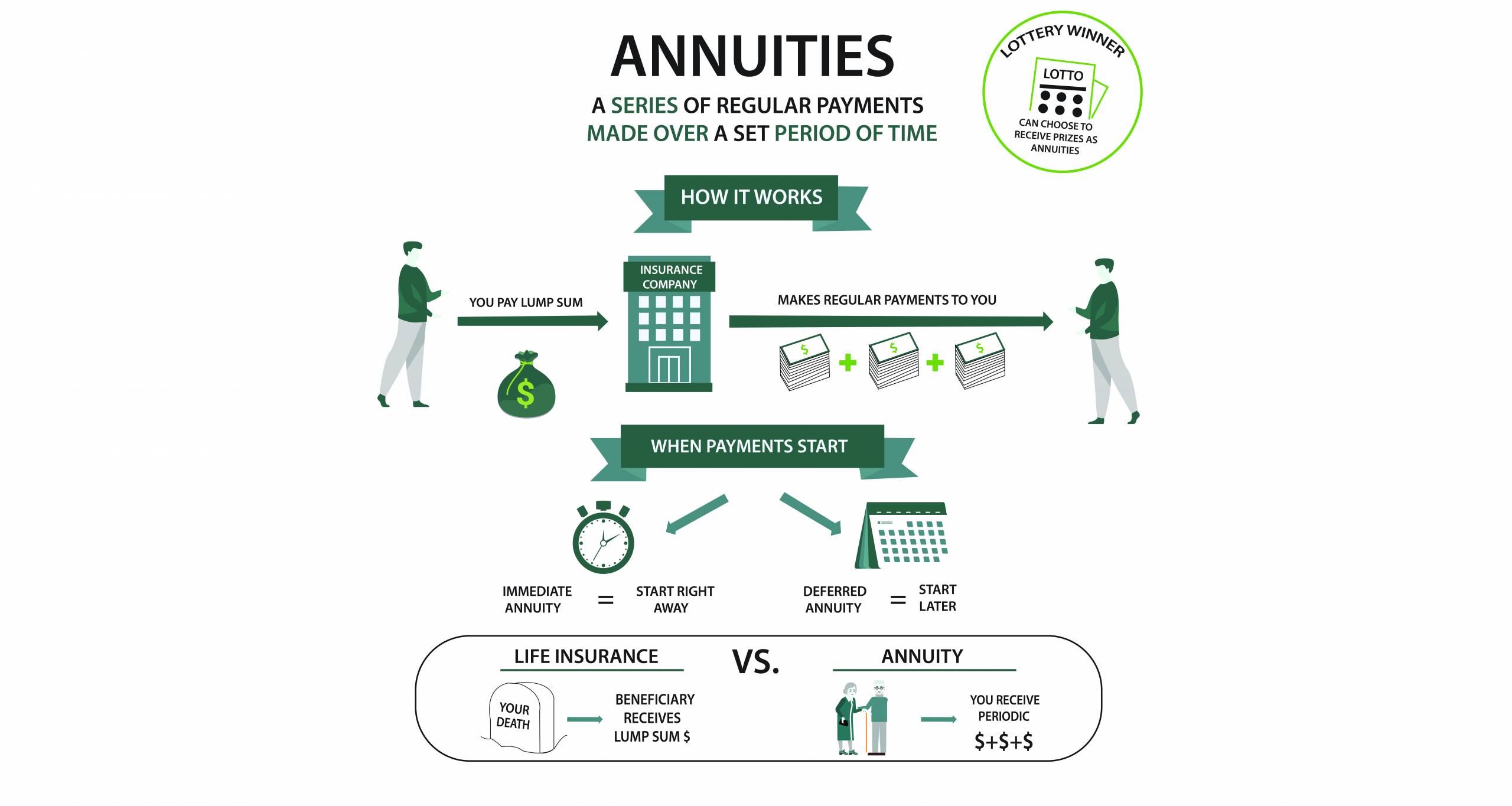

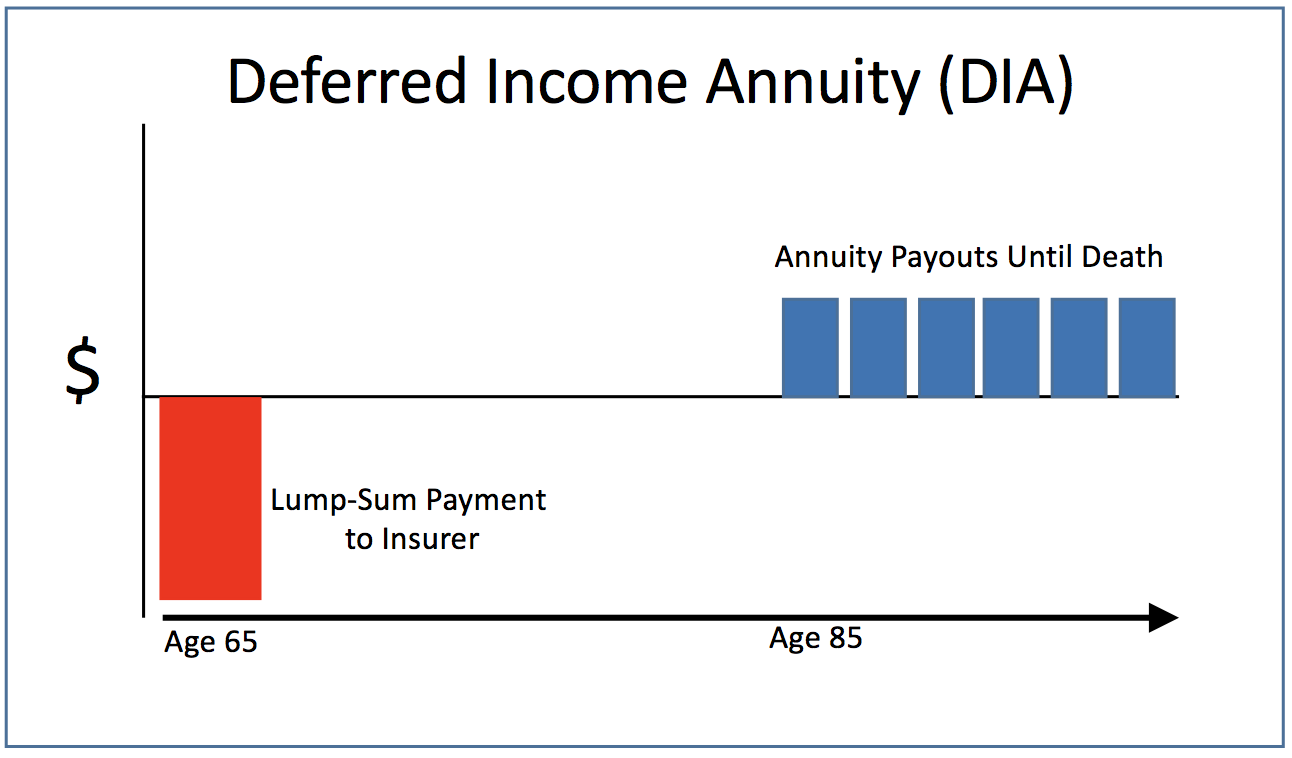

Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for.

. Ad Find the Info related to your query. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. Pays you the same exactly amount every month for the rest of your life you can simply compare the payout of the annuity with the payout you could.

Further Your Investing Goals - Get Matched With 3 Investment Advisors in Minutes. In a multi-employer plan payouts are limited to 3575 per month times years of. Ad This guide may help you avoid regret from making certain financial decisions.

Get your exclusive free annuity report. Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump sum. 50 joint and survivor annuity.

Moreover the factor of inflation is. A life annuity with period certain is a hybrid option that provides lifetime. Ad Find An Investment Advisor Who Gets You Your Goals.

Term life insurance policy can be bought be elderly citizens in their 60s or early seventies. The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected. 100 joint and survivor annuity.

The Lump Sum 138000 if compounded at 5 for 17 years would grow into 316000. If you take the lump sum and expect to live another 18 years you have to. This is a good check on our math as both the Annuity and Lump Sum tend to be.

Ad Learn More about How Annuities Work from Fidelity. Find out what the required annual rate of return required would be for. Annuity companies look at the average life expectancy of your age group and primarily base the pension income on that with interest rates playing a secondary role.

The former provides an immediate up-front amount say 300000 but the pension. Term Life Insurance Rates for Seniors. If the annuity is fixed ie.

There are a lot of benefits to buying a. Not surprisingly the monthly payout will be higher with a single-life annuity than if you opt for the joint-and-survivor benefit because the expected payment period is longer. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

For instance if you elect a single-life annuity with a 10-year period-certain option then if you passed away four years after you started collecting payments your beneficiary. Both options offer retirees. Annuity or Lump Sum.

Your company gives you a choice of a 300000 lump sum or 2000 a month in a single-life annuity. SPIAs are commodities that need to be. Is a lump sum offer from an employer a better choice than a pension annuity for life.

Ad Annuities provide guaranteed returns with no market risk. Use the Lump Sum vs. A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level.

Projected annual income needs. Single life annuity. In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average.

Difference Between Annuity and Lump Sum. In a single-employer plan the maximum annual benefit the PBGC pays to a 65-year-old is 67295. Search For the Latest Results at Bestdiscoveriesco.

Life annuity with 10 years certain. Annuity Calculator from North American Savings Bank to help determine whether its better to get a lump sum or receive an annuity. Individuals who already have sufficient income sourcesthrough Social Security other pension benefits or a large portfolio might find an.

This tool compares two payment. Ad Learn More about How Annuities Work from Fidelity. Click here to learn ways Fisher Investments delivers clearly better money management.

Annuity Payout Options Immediate Vs Deferred Annuities

Period Certain Annuity What It Is Benefits And Drawbacks

Put Your Pension To Work Immediateannuities Com

Strategies To Maximize Pension Vs Lump Sum Decisions

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Annuity Payout Options Immediate Vs Deferred Annuities

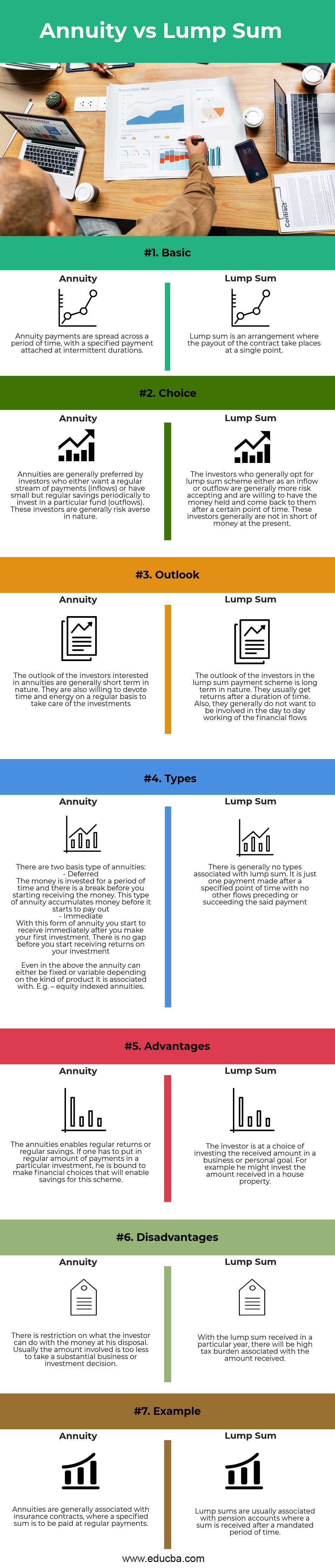

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Difference Between Annuity And Lump Sum Payment Infographics

Income Annuities Immediate And Deferred Seeking Alpha

Annuity Beneficiaries Inherited Annuities Death

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Lottery Payout Options Annuity Vs Lump Sum

Difference Between Annuity And Lump Sum Payment Infographics

When Can You Cash Out An Annuity Getting Money From An Annuity

Lump Sum Payment Definition Finance Strategists

Life Insurance Vs Annuity How To Choose What S Right For You